A 1031 exchange gets its name from Section 1031 of the U.S. Internal Revenue Code, which allows you to avoid paying capital gains taxes when you sell an investment property and reinvest the proceeds from the sale within certain time limits in a property or properties like kind and equal or greater value.

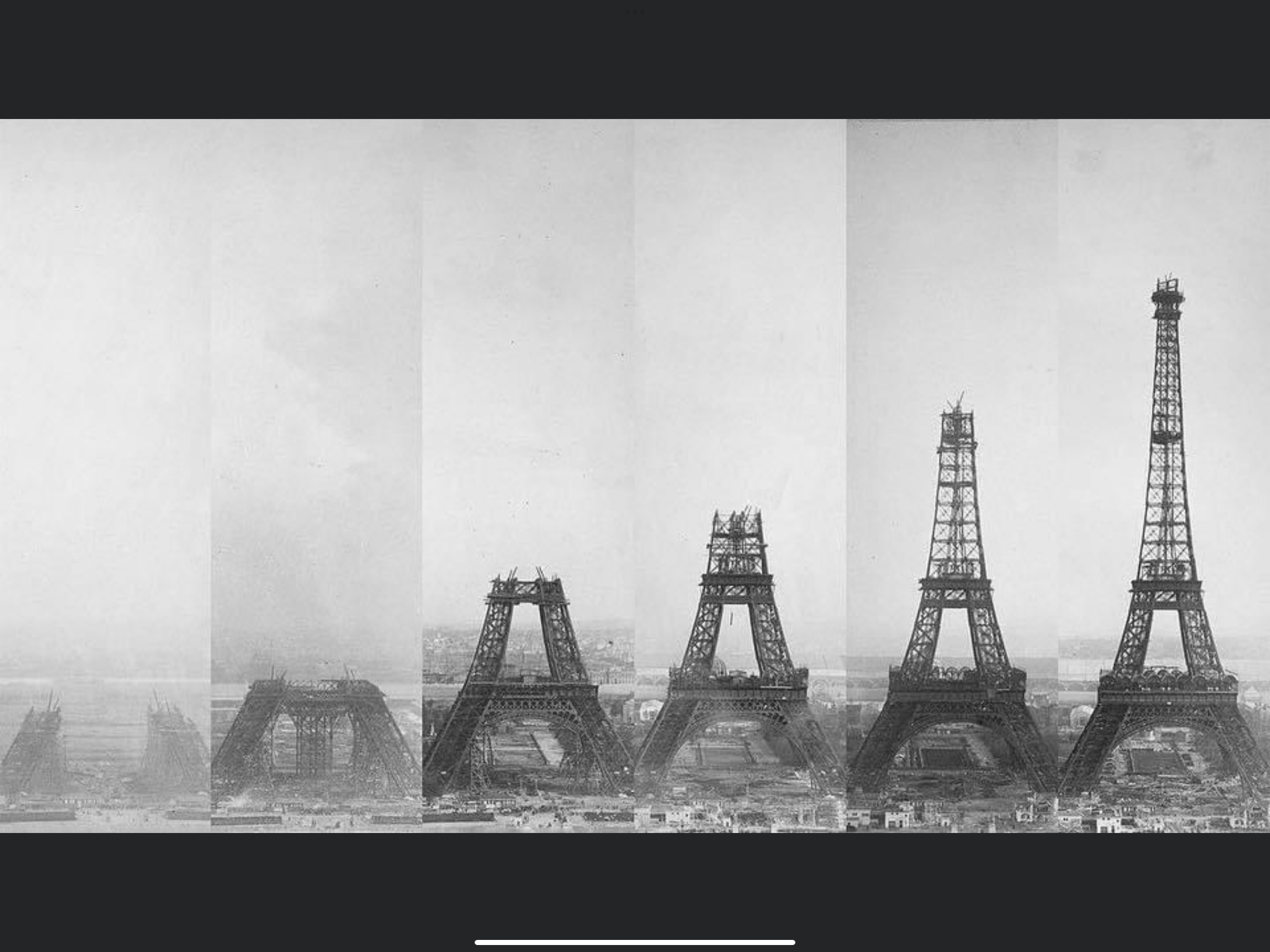

Not dissimilar to the photo below showing the progress of the famous tower, a 1030 Exchange can allow an investor to keep building up a real estate portfolio. Unfortunately, skilling environmental due diligence on a commercial site can be a costly mistake when remediation is needed.

As a real estate investor, a 1031 Exchange can allow you to leverage your investment in real estate. In the environmental due diligence world, we find that 1031 Exchanges tend to skip over environmental due diligence, which places the parties involved at risk. People need to understand, that the owner of the property = the RP. (RP = Responsible Party). Even in situations where the seller agrees to perform the remediation, we have seen RP's disappear and regulatory agencies will also look toward the owner of the real estate.

Generally speaking A Phase I Environmental Site Assessment should be performed for all commercial real estate transitions, including 1030 exchanges. Learn About Phase I

Let's start with the appeal of the 1031 Exchange

First, it allows an investor to pick a new property that allows a greater ROI or diversify the portfolio of properties.

You can use the exchange to consolidate several properties into one asset or vice versa acquiring more properties in exchange for one more valuable one, possible for estate planning.

On an accounting basis, you can reboot the depreciation clock. Meaning rather than simply selling one property and buying another one the 1031 exchange allows you to defer capital gains tax, thus freeing more capital for investment in the replacement property.

That all sounds great right? Well, the environmental rub is there are time frames for 1030 to execute and we are finding many people have skipped over doing environmental due diligence including Phase I, II & III. The rub is all Phase I studies follow an outline established by ASTM. ASTM updates the standard every 8 years. Generally speaking, when a change occurs Phase I becomes more inclusive. a Phase I from 20 years ago would be a faster read than one today. So you can expect that today's Phase I will be more thorough.

The oil that leaked from this previously sealed pit is now the owner's responsibility to address.

How do you protect yourself with a 1030 Exchange?

Real estate transactions are complicated and 1031 Exchanges add a short window to identify properties, which makes people cut corners.

- Be savvy and have your environmental consultant evaluate the potential sites. You can start with a cursory environmental evaluation to find any red flags, you don't always have to do a Phase I. You can do a Records Search with Risk Assessment (RSRA): Which is where an environmental professional obtains, reviews, and summarizes an ASTM 1527-21 compliant database for the noted property and the surrounding one (1) mile. The review will focus on any pertinent listing for the Subject Property as well as any surrounding properties which could pose a potential Recognized Environmental Concern (REC). The environmental professional will also perform a reconnaissance of the Subject Property. (Access to interior building areas must be granted.). RSRA's can be converted to Phase I after the decision is made to pursue the property. RSRA's are helpful if you are evaluating multiple sites but only plan on acquiring one of them. Now an RSRA is not a substitute for Phase I but rather a way for an investor to evaluate multiple properties without fully committing to Phase I.

- Of course, you can also perform a Phase I for the target property. Savvy investors will get the target property owner to share the cost of the Phase I which will allow both buyer and seller to retain rights and use of the report, in case the 1031 Exchange does not go through.

- You can also have the owner perform the Phase I as a condition of your acquisition. Hey to be fair, the property is going to need to have a Phase I for any buyer and many sellers contract for the Phase I to help expedite sales, even before the property is listed for sale. Realtors take note, properties with a completed current Phase I go to settlement faster. Buyers can always have the Phase I peer reviewed by an environmental professional. Curren Environmental peer reviews a few hundred Phase I reports every month, so this is not uncommon.

- At this point we hope you have a bit more knowledge about Environmental and 1031 Exchanges. Want to know more? Call an environmental professional.

Pro Tip: Curren Environmental has been doing Due Diligence for close to three decades (Yea we are old). When you need a Phase II, well we just pivot and come back to the site with some of our equipment. 90% of other companies call a subcontractor which adds cost and time.